Wills, Trusts & Probate

Click the red “Get an Instant Quote” button above to begin our questionaire. This will help you determine what estate planning products you truly need and how much they will cost.

Why Hopkins Solicitors?

Our Wills & Estate Team have one of the highest client satisfaction rates in the entire country. We are proud of the friendly service they provide and their high accreditation level means you can rest assured that the quality of their work is of the highest level.

Most of us feel uncomfortable thinking about our own death or the death of a loved one. However, none of us are immortal so it’s important to think ahead in order to give you and your family peace of mind, and reduce the risk of unrepairable family disputes in the future.

If you are unfortunate enought to have a loved one pass away, understanding the Probate legal process and responsibilities of an Executor can be stressful and time consuming. Our caring team are here to offer you our legal services, leaving you to focus on what is most important, supporting your family.

Our starting prices are shown below:

- Simple Wills start from £300+VAT

- Lasting Powers of Attorney start from £400+VAT

-

Writing Your Will

Looking to Secure Your Family’s Future? Trust Hopkins Solicitors to Draft Your Comprehensive Will. Don’t Leave It to Chance—Your Legacy…

-

Probate & Estate Administration Support

Navigating the Complex World of Probate? Let Hopkins Solicitors Simplify the Process for You. Dealing with Loss is Hard Enough—Let…

-

Lasting Powers of Attorney

Need Guidance on Lasting Powers of Attorney? Trust Hopkins Solicitors to Lead the Way. We Make the Complex Simple—Helping You…

-

Court of Protection

When a member of your family has lost mental capacity, requires assistance in managing their financial or health affairs and…

-

Trusts & Deed of Gifts

Are you looking to preserve family assets for your nearest and dearest? Or do you want to help your family…

-

Property Trust Wills – protection from care home fees

-

Disputing a Will

A dispute over a Will can cause considerable distress when dealing with the loss of a relative or someone close…

Request a Callback

"*" indicates required fields

Meet the Team

Testimonials

-

Professional, friendly, efficient knowledgeable, gave us peace of mind,answered all our questions with explanations and listened to us. Thank you Abbie and Joanne.

Stephen Merrin, 11th September 2024

-

Priya was very knowledgeable and assuring, she helped point out a few additional points we hadn’t even thought of and gave us the upmost confidence in her advice.

Lynsey Butler, 20th August 2024

-

Abbie was great from start to finish.

Kerry Booker, 20th August 2024

-

Everything explained thoroughly and in a way we could understand.

Katy Davison, 6th August 2024

-

Abbie was friendly, listened to what we needed and told us the best way to go about it

Anthony Twigger, 25th July 2024

Related Articles

-

What if you can’t find someone’s Will? Is there a national database I can search?

We always tell our clients that the legally binding version of their Will (the original signed copy) should be kept…

-

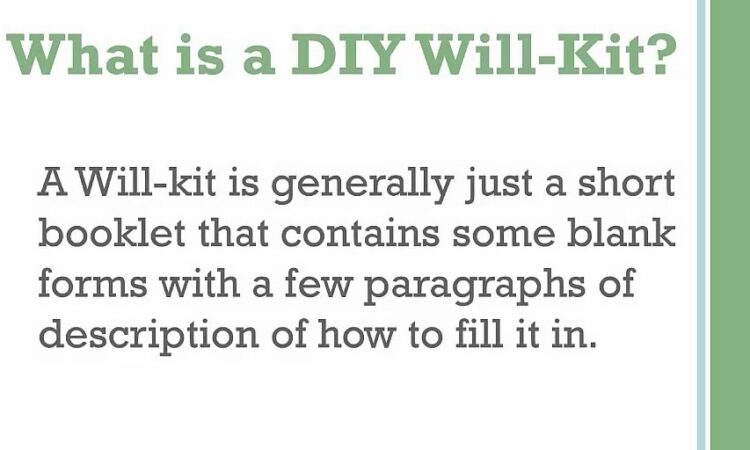

DIY Wills: Beware of the risks

When you feel the time is right to make your first Will, or update an existing one due to changes…